This certificate is ideal for small business owners, those currently working in QuickBooks or those looking to go into the bookkeeping field. It is possible to take and pass the exam before you have obtained your 2 years of experience. According to the Bureau of Labor Statistics, there are a lot of jobs for bookkeepers, and the job outlook is expected to remain relatively constant through 2026.

- Students who spend five hours a week on the curriculum can finish in three to four months.

- Get information on Professional Bookkeeping programs by entering your zip code and request enrollment information.

- However, bookkeepers with certifications and experience may earn more than entry-level accountants.

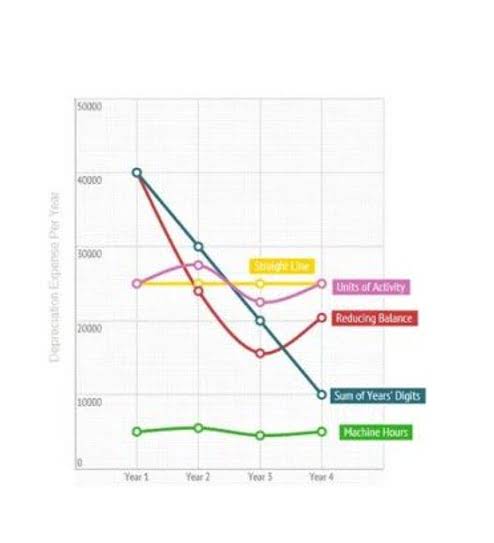

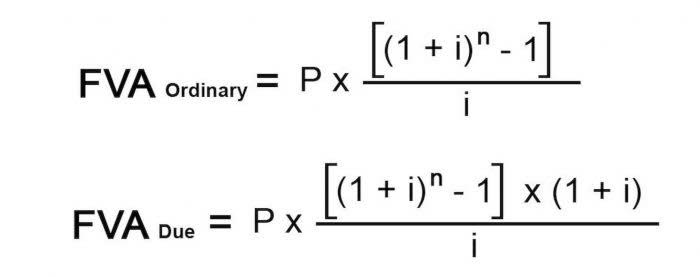

- However, it does suggest that candidates thoroughly understand depreciation, payroll, error correction, internal controls, inventory management, and entry adjustments.

- NACPB exams occur online and must be scheduled at least one or two business days before the exam date.

Mt. San Antonio College

- In the world of business operations, the roles of a bookkeeper and an accountant are indispensable.

- As noted above, NACPB and AIPB both require annual fees as well to keep members’ credentials current.

- To register for the CB exam, a bookkeeper must fill out an application with their identifying information and bookkeeping experience.

- Self-paced courses are designed to be user-friendly and independent, minimizing the need for external support.

- He is currently Director of Finance and Administration for New Children’s Museum.

Remember, while certification is not always mandatory for bookkeeping positions, it can significantly enhance your professional profile and increase your marketability in Georgia’s competitive job market. Each structure has its advantages and considerations regarding liability, taxes, and regulations. It’s a good idea to consult with a business advisor or attorney to determine the most suitable structure for your bookkeeping business. To begin, consider registering your bookkeeping business with the appropriate authorities in Georgia. You’ll retained earnings need to decide on a business structure, such as a sole proprietorship, partnership, or limited liability company (LLC).

Best for students with bookkeeping experience

Learn about start dates, transferring credits, availability of financial https://www.bookstime.com/articles/what-is-r-t-tax-credit aid, and more by contacting the universities below. Meghan Gallagher is a Seattle-based freelance content writer and strategist. In Marketing Management and a background in digital marketing for healthcare, nonprofit, and higher education organizations. Moreover, both the CB and CPB credentials are respected in the bookkeeping field and can help you stand out to employers. Note that NACPB’s bookkeeping certification is different from its CPB license.

Franklin University

Still, AIPB suggests that accounting georgia candidates have a strong educational background in topics covered by the exam, like fraud prevention and inventory recording. By earning certification, bookkeepers have proven their skills in accounting, taxation, financial accounting, and other related concepts, giving them an advantage when applying for jobs or promotions. The first step to becoming a certified bookkeeper is ensuring you’ve met all professional and educational requirements. Regardless of whether you are pursuing credentials through AIPB or NACPB, your supervisor or a former employer must validate your experience hours.

- With this online version, you get all the advantages of computing in the cloud so that your files will be available to you virtually anytime, anywhere.

- The certification process typically involves meeting specific educational requirements and passing an exam.

- However, each program is different, so consider what you want to get out of a prospective program before you enroll.

- Our Professional Bookkeeper™ Program course consists of 20 – 67 hours of training over 4 modules (listed below).

- He has previously served as an instructor for courses at Coopers & Lybrand and UC San Diego.

Thousands of students have successfully completed our program and now enjoy great success either in their professional careers or in the establishment of their own accounting practices. We are confident that this program will satisfy your desire to master small-business accounting and take control of your professional future. Bureau of Labor Statistics, the median bookkeeper salary is $45,560 annually.